Gelato Network a hidden Champion?

Review the market leader in automated transactions, including a closer look at its products, how they work, and what to expect in the future.

The Gelato Network is a decentralized infrastructure protocol layer for blockchain protocols, allowing automated, gasless, and more efficient smart contract executions. In more detail, the Gelato Network is initiating and transacting blockchain transactions dependent on offchain data in a fully automated ecosystem.

The Beginnings

The two young German developers Hilmar Orth and Luis Schliesske started their profound crypto journey in early 2017 by visiting a bunch of hackathons (where they also won a couple of prizes), helping with a few smart contracts for decentralized exchanges (first AMM on IPFS), lending platforms and were also involved with MakerDAO. Later, they received a grant from Gnosis, built the first smart contract for an automated cost average strategy, and founded Gelato Network.

B2B

Gelato is a typical B2B organization: usually unknown to the end-users but well-known and respected in the developer community. With over 4 million transactions processed, their automation smart contracts can be found in many projects like MakerDAO, Pancakeswap, Yearn, Optimism, Connext, Multichain, Zed.run, gasless NFT mintings (e.g., Renault), Lens, etc.

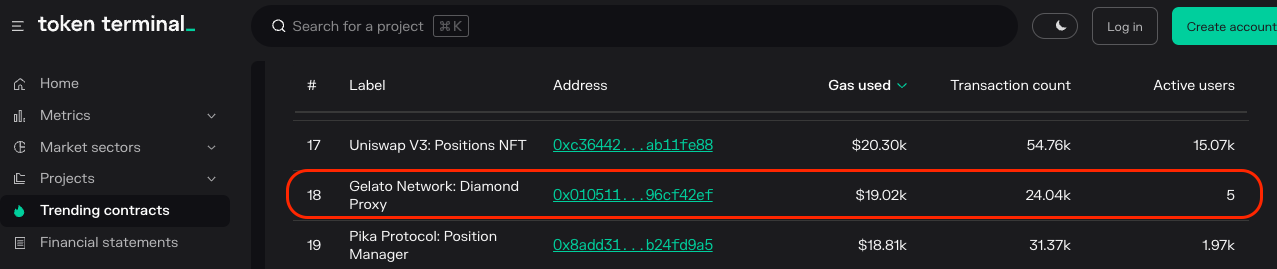

For example, when checking for trending contracts, the Diamond Proxy1 is among the top 20 most-used smart contracts on Optimism with 24k transactions.

Some Gelato contracts automatically adjust gas fees based on the current market conditions, ensuring users get the lowest possible transaction fees. Another issue solved by Gelato is integrating the Web3 world into the vast Web2 world. We shall come back to this point in the chapter Account Abstraction. Gelatos services are spread across all crypto verticals, and their product portfolio is as follows:

Yield Farming

Harvesting on Yield Farming Vaults used by protocols (Beefy Finance, Harvest Finance, etc.)

Rebasing for algorithmic stablecoins (Olympus DAO)

Preventing user liquidations

Reward claiming & compounding rewards

Oracle

Automated TWAP (time-weighted average price) Oracles are used in ten protocols

Funding wallets

Bridge - Gasless Cross-Chain Asset Bridging

Gaming (keyword: community-driven game development)

NFT Lending periods (enables automatic returning of the NFT)

Requesting & consuming randomness

Periodic reward distributions

Automating gameplay loops

Gasless minting of NFTs

DeFI

Management of money streams

Funding wallets

Preventing user liquidations

Dollar-cost averaging

Token transfers or burns

Cross-chain reward distribution

DEX - limit orders on AMMs (Automated Market Makers)

DAO - periodic reward distributions

Derivatives - Limit Orders for Derivatives

Gelato, the Account Abstraction Enabler

In practice, Gelato’s SDK solutions’ enable account abstraction - a buzzword that could become the next big narrative in crypto.

Gelatos’ smart contracts can abstract gas fees for its users by paying the fees on behalf of the customer (who then could pay with a credit card, as seen with the Renault NFT airdrop). Consequently, the Web2 customer does not need to be onboarded to crypto anymore and does not need any tokens to pay gas fees. Gelato removed the barrier of onboarding and basic crypto knowledge, which will help to grow crypto usage further.

Gelato can eventually abstract all networks on behalf of different protocols, and Gelatos customers need to relate to Gelato only via their preferred network.

How does the Gelato Network work?

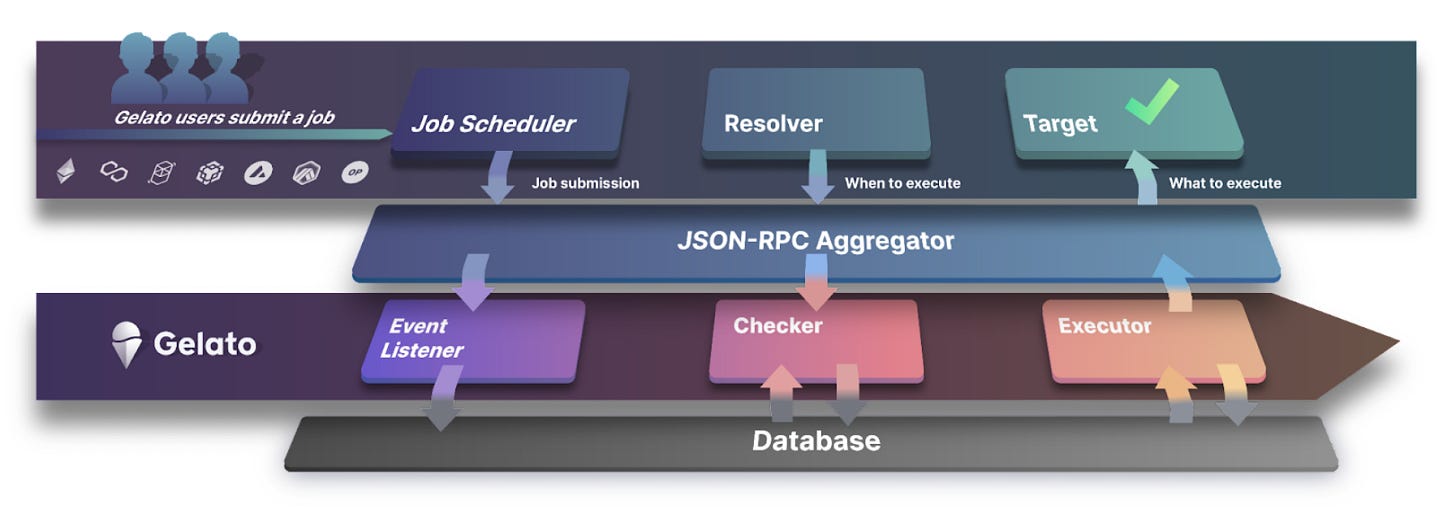

The Gelato network continuously checks whether the conditions for a task to execute have been met. In short, the Gelato network runs with three roles: the Event Listener, the Checker, and the Executor.

The Event Listener is responsible for continuously querying the blockchain and monitoring emitted events. The Checker defines arbitrary/custom logic to check if a Gelato task is executable at a given moment. The Executor is responsible for reliably submitting transactions on a chain and ensuring they are mined as quickly as possible with the lowest cost.

Gelatos’ Vision

The vision of Gelato is not to scale up to a large firm but to build a decentralized network that enables developers to build new dApps that are trustless (or trust minimized), transparent, auditable, and without a single-point failure.

Hilmar mentioned in an interview that his dream would be to one day be able to “shut down the firm”, and the Gelato DAO would then fully support the model instead. GEL works similarly to the Ethereum staking model: the Gelato Network has node operators who run decentralized servers and computational services to automate transactions (smart contracts) and do plenty of microservices, such as checking and sending data. When running these services, costs occur that are compensated by staking. The necessary staking rewards are then earned from the protocols using Gelatos services.

Competitors

When defining Gelato’s market as a decentralized cloud service network, Gelato enables automated transactions that are unavailable onchain. Gelatos’ most significant competitor in this market is Chainlink’s decentralized oracle network, which provides reliable, tamper-proof inputs and outputs2 for smart contracts on various blockchain platforms. Chainlink is a giant infrastructure protocol with a market capitalization of $3,4 billion and has over 600k addresses holding LINK tokens (Ethereum).

They are the market leader for offchain data, while Gelato is the market leader for automated transactions, where Gelato has executed 78% of all transactions, followed by Chainlink and Keep3r.network. Gelato and Chainlink came from two different markets and met a while ago and progress in each other’s markets where it makes sense.

The Keep3r Network, by the way, has a more independent approach and provides only a marketplace for businesses to find external providers (so-called keepers) to perform specific tasks. Their KP3R token has a comparable market capitalization with GEL.

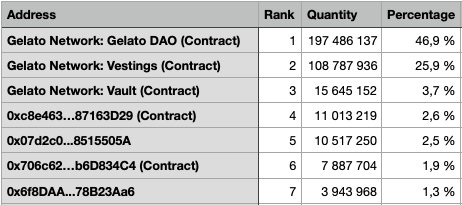

GEL Token

The GEL token is an ERC-20 token. The Gelato node operators (executors) will need to stake GEL to earn fees by providing off-chain computation resources and executing transactions.

Initially, Gelato Network did a token allocation where the team received 25%, private sale investors received 21%, and 4% went to the public sale investors. The remaining 50% was handed over to the Gelato DAO, which decides further distribution. Any token holder can then propose, e.g., developments of new smart contracts to the DAO, and the DAO could then finance these endeavors through further token sales.

The maximum total supply is 420 690 000 GEL; the token is not mintable, the contract is verified, and it can be traded via Uniswap V3 Liquidity Pool.

Hilmar sees infrastructure projects as long-term plays. According to this, it makes more sense to go for sustainable growth instead of selling GEL immediately. Also, the purpose of GEL is to increase the usage of the network and its smart contracts instead of promoting liquidity mining and incentive schemes.

Summary & Conclusion

The Gelato Network has immense potential to become a widely used infrastructure layer for dApps when it follows the industry's (volatile) path. The GEL token will then see increased demand accordingly. The founders follow a conservative token policy, and it is in the interest of the founders not to flood the market with GEL tokens. The value of the GEL token is mainly determined by the value of the young network, as the smart contract expertise is a short-term competitive edge in my eyes.

The founders have positioned Gelato in

all verticals like DeFi, NFTs, bridges, gaming, and DAOs

expanded into the most common smart contract blockchains as their ecosystems grow to sizes of interest.

In the growing EVM-compatible ecosystem, Gelato has a stronghold. However, keeping up with the rapidly changing space cost is high for a small network. A new generation of blockchains emerged without mempools or MEW (Maximum Extractable Value), and they speak more modern languages than Solidity. Gelato needs to identify the most promising blockchains early, learn the differences and adapt/adjust their technology accordingly, and ideally occupy the space meant for Chainlink before they enter the market. There might be a classical dilemma between entering early and entering late. Both have their advantages and disadvantages. I trust that Hilmar and Luis follow their instincts and are not dogmatic regarding EVM.

Has Chainlink recognized transaction automation as an attractive field to gain control over? Chainlink has grown too big to focus on this niche (as it is today). It is easier to keep growing with the larger offchain data market, where it must secure its market leader position (and roll out additional blockchains). Today, Gelato has no serious competitor in its core market and can expand further to the offchain data market. Gelato could then become a threat to Chainlink’s core market, and Chainlink could then seek to attack Gelato on its home turf.

Gelato has a robust product-first approach but realized that in the end, often, only sometimes the best product necessarily wins but the best business development and marketing. The DAO has increased efforts in that direction in the last few months. Here, they have learned from Chainlink, which puts business development before the product.

We are probably all asking ourselves what the next bull runs’ narrative(s) will be. I think with Account Abstraction and Automated Transactions, Gelato serves two fresh narratives very well that might be part of it.

The Diamond Proxy contract is a special type of smart contract that allows multiple contracts to act as a single contract. It's like a container that holds several smaller contracts, and each can be upgraded or changed without affecting the overall functionality of the Diamond Proxy Contract. This allows for greater flexibility and scalability in smart contract development, as developers can add new features or fix bugs without redeploying the entire contract. It also helps reduce gas costs and improve efficiency by allowing multiple functions to be executed in a single transaction.

In non-technical terms, consider it a house with multiple rooms, each representing a smaller contract. If one room needs to be renovated or modified, you can do so without affecting the rest of the building. The Diamond Proxy contract serves as the main entrance to the building, allowing access to all the different rooms.

Outputs are the opposite case when, e.g., the blockchain triggers an executable task such as a fiat payment.