A common Scam in Crypto: The Honeypot

Honeypot Scams in the Crypto Space on the example of the Sad Pepe Memecoin

Bob was excited to invest in a new meme coin called SadPepe. All other new meme coin token launches went through the roof recently. Bob did his due diligence and checked the project and the token contract as well as he could as a non-technical person. The trading started at 8:00 pm and initially seemed promising with both buys and a few sales. The project developer shared several links in the Telegram group about his access renouncement (so that he cannot change the code), the transaction with the burned receipt of Uniswap tokens (so that he cannot drain the liquidity pool on Uniswap), and a link that proved that he locked 1,5 million SPEPE tokens for 6 months. Everything looked good, and the honeypot detector also gave the green light.

The token slowly rose, and Bob swapped some Ether for SPEPE. After a few minutes, there were only bought shown on Dextools. However, things quickly took a turn for the worse.

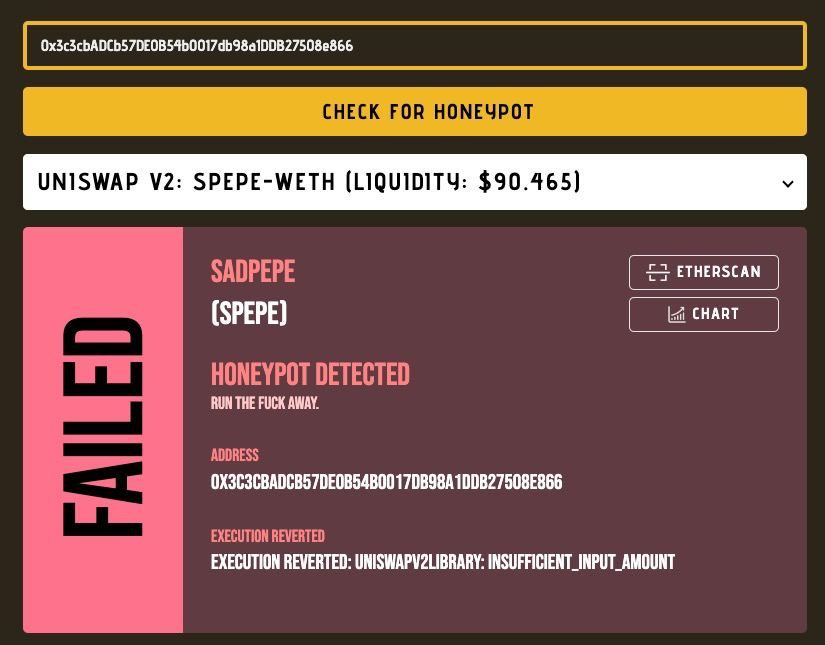

Bob checked Honeypot.is again and was shocked to see the warning:

"Honeypot detected. Run the fuck away."

He then tried to sell his tokens but encountered an error message on Uniswap every time he tried, fiddling some time with the slippage tolerance. Upon further inspection, Bob discovered that the sales tax had been changed to 100%, rendering the contract unrenounced.

This experience taught Bob an important lesson - if you're not a Solidity expert, it's difficult to protect yourself from honeypots and other scams in token launches. The best approach is to wait until Solidity experts have given their approval before investing1.

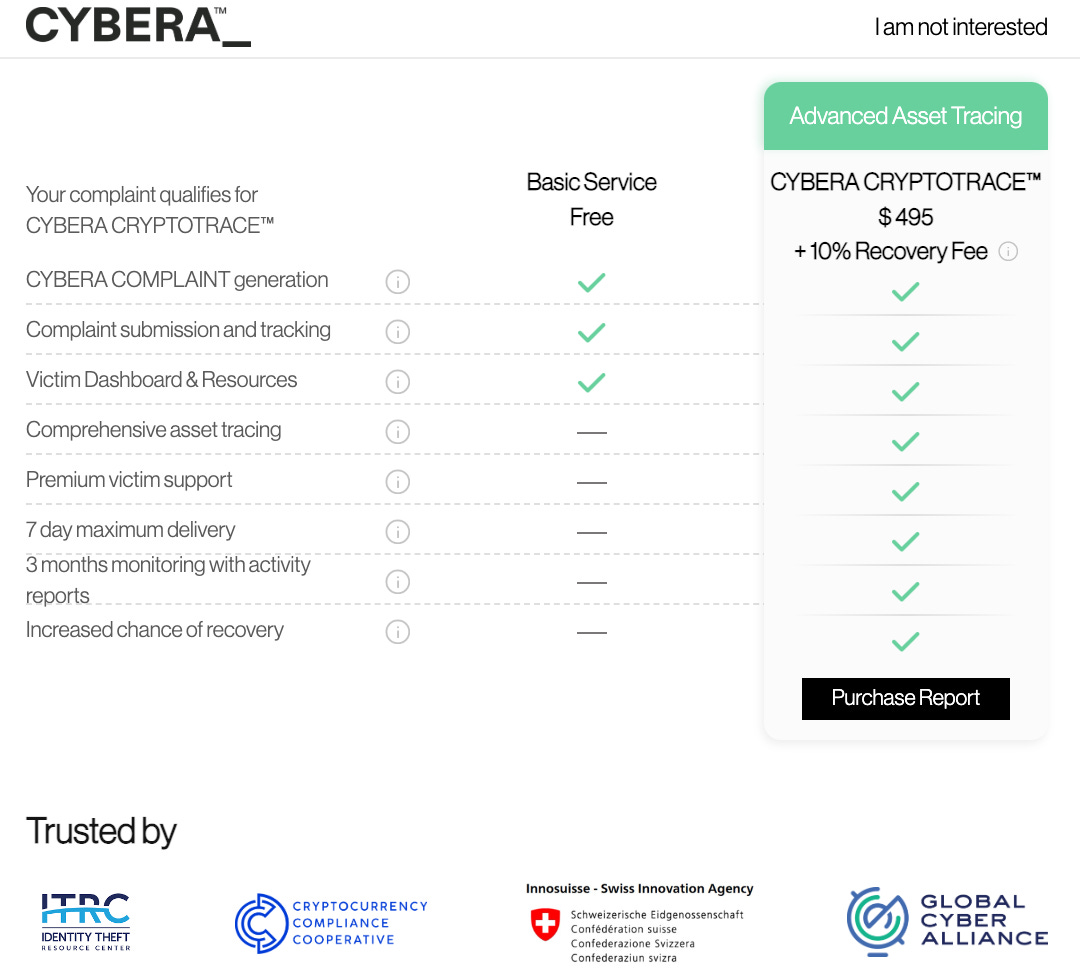

Bob realized that the best course of action was to report the scam to the relevant stakeholders, such as Telegram, Twitter, and Dextools, to prevent others from being scammed. Additionally, Bob considered filing a case towards authorities, as this can often be done online. In some countries, deducting losses from fraudulent investments in your tax declaration is possible. Having the fraud officially documented will be a good investment of time. Therefore, Bob filed a complaint towards Cyberia, who helps increasing the chances of recovering stolen funds.

Ultimately, the blockchain never forgets, and scammers who leave clear traces through their funding from, e.g., a Binance account, domain service payments, or when trying to cash out may be caught in the future.

Scammer address with initial funding: https://etherscan.io/address/0xcd6eb858c4affe71462a385dc8eb74acdbc1bfc6

Withdrawal of funds: https://etherscan.io/token/0x3c3cbadcb57de0b54b0017db98a1ddb27508e866#tokenTrade

While the promise of early gains may be tempting, it's important to exercise caution and do thorough research before investing, particularly in meme coins, as these projects are set up in a few hours at maximum and are among the group of most frauds.

The ‘premium of apprenticeship’ might be too expensive if you are not a Solidity developer. You should focus on projects where enough skilled eyeballs have taken a look before you. After all, there are so many other opportunities with a better chance-risk ratio than with investments into early meme liquidity pools.